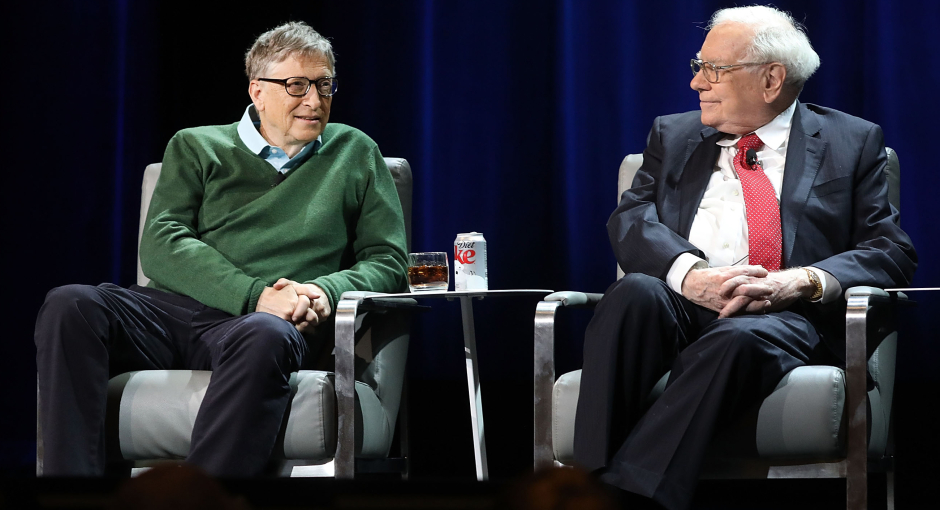

The billionaire investor and Berkshire Hathaway’s CEO, Warren Buffett has again described the top cryptocurrency as “probably rat poison squared,” at the annual meeting of his company and on another occasion, while talking to CNBC he said that Bitcoin is “creating nothing.”

The Berkshire Hathaway’s Chairman said; “When you’re buying non-productive assets, all you’re counting on is the next person is going to pay you more because they’re even more excited about another next person coming along.”

Rewind a few months, and Buffett was declaring that cryptocurrencies in general “will come to a bad ending.” Go back several years further, and he was dubbing Bitcoin “a mirage,” arguing that “the idea that it has some huge intrinsic value is just a joke.”

Do cryptocurrency investors care what Warren Buffett has to say on the subject? The price is certainly down since his broadside, though as ever it is hard to say what has caused Bitcoin’s latest fluctuations.

Recently, Bitcoin looked like it may break through the $10,000 barrier for the first time in two months, but since then it has slumped to a current value of around $9,330.

The cryptocurrency market is largely down in the last 24 hours—Bitcoin by 2.4%, Ethereum by 6.8%, Ripple by 5.3% and Bitcoin Cash by 6.5%.

Last week, Nikkei reported that Japan’s financial regulators were planning stricter review standards for cryptocurrency exchanges. CNBC also reported that DataTrek Research co-founder Nick Colas—the first analyst on Wall Street to have covered Bitcoin—was advising that now is not the right time to buy Bitcoin, as growth in new entrants to the market is shrinking.