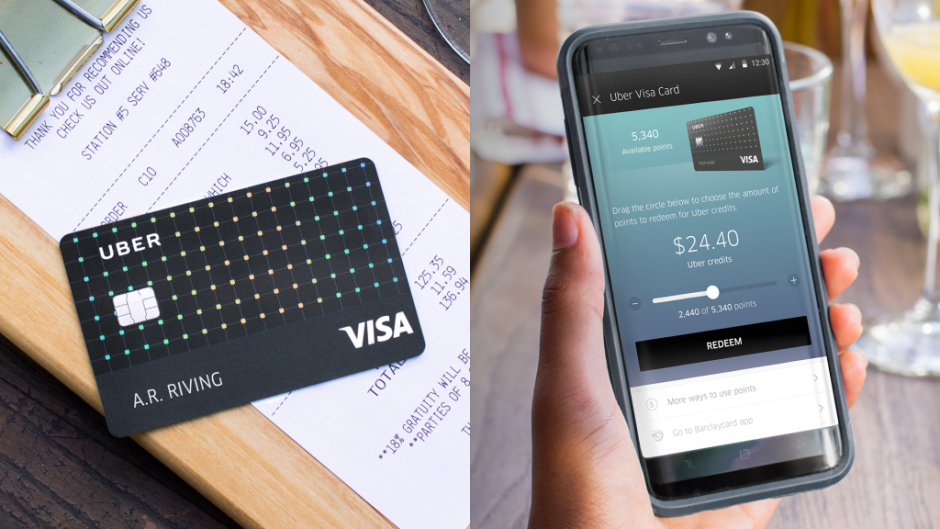

Uber introduces its own credit card

Yes, Uber is getting into credit card business. The company has announced its own credit card today at Money 2020 Conference. Uber has partnered with Barclays and Visa to introduce its own cards.

The card can be used anywhere like restaurants, hotels, stores, and of course Uber rides. The card has no annual fee and it offers rewards for making purchases with it. You’ll get a bonus of $100 on spending $500 in first 90 days. Moreover, it offers some other perks like 4 percent credit back on restaurants, take-out and bar purchases; 3 percent back on purchasing online tickets, hotels, and Airbnb; 2 percent back on online purchases; and 1 percent back on every other purchase (I know its cool).

How to apply for the card?

Uber will let you apply for the credit card from November 2, Pakistani users can also apply. You will be able to apply for the card within the Uber app. You’ll have to complete a form with all the information asked and you’ll get the approval notification “within minutes”. Once the card is approved, you can start using it online right away. The physical credit card will arrive in the mail within a week or so.

The announcement article is available on the official Uber Pakistan site as well, so we are assuming that you’ll be able to get the card in Pakistan as well.

The credit card will be fully integrated into the Uber app experience. David Richter, global head of business & corporate development at Uber, said:

“We are always looking for unique ways to surprise and delight our riders, which is the reason we built the Uber Visa Card. We partnered with Barclays to design a credit card that is not only custom-tailored to reward our customers’ everyday lifestyle, but is also fully integrated into the Uber app experience.”

Are you planning to get the Uber credit card as soon as it arrives? Well, I’m.

Uzair has been very tech savvy since his childhood. He’s a passionate writer for all things related to technology and a Computer Science graduate.

2 min read

2 min read