According to the research conducted by Topline Securities titled “Pakistan Market Outlook 2021: A year of economic stabilization”, PKR/USD is likely to close around 166 in Jun 2021 and 172 by December 2021. However, that should not be alarming as the overall market is expected to do good and Pakistan is likely to head towards economic stabilization by the end of 2021.

The rupee will fluctuate around 155-175 during 2021 according to the report. The research is very accurate as can be seen from the 2020 version of the report which expected the rupee to depreciate to Rs158 by Jun-2020 and at Rs162 by Dec-2020.

The report says, “We have set an KSE-100 index target of 52,500 by Dec-2021, which is an upside of 25% (USD-based: 18%) from here. In 2020, KSE-100 index is up just 4% (YTD), in spite of a sharp 55% recovery from its bottom in Mar-2020.”

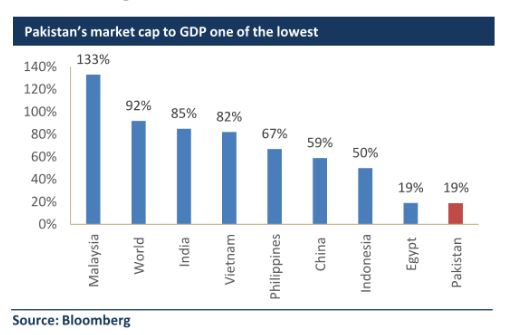

The report also suggests the GDP is expected to grow by 2.0-2.5% in the Fiscal Year 2020-21 (FY21). The average GDP growth in the last 10 years in 3.5%. Pakistan’s market cap to GDP ratio is still on of the lowest around the world. Moreover, monetary tightening is expected to start in May 2021 with a likely increase of 75-100bps in the policy rate by the State Bank of Pakistan (SBP) in 2021.

They say, “We believe the year 2021 to be a year of economic stabilization and consolidation as the impact of COVID-19 dissipates on arrival of vaccines.” They also believe that Pakistan is not likely to enter the FATF white list in Feb 2021. IMF is also expected to reenter Pakistan during the first quarter of 2021.