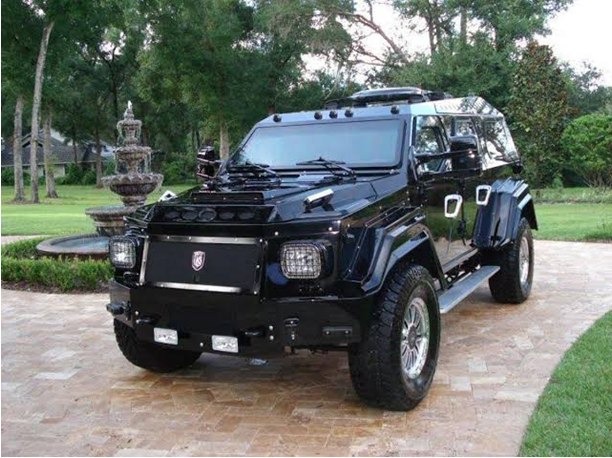

After retirement, Senior Army Officers now can enjoy duty and tax-free import on bullet-proof vehicles, up to 6,000 ccs, as announced by FBR

As the security situations in the country are getting worst day by day and everyone is concerned about security issues. It is a reliable piece of information that FBR issued a notification in this regard on Friday. The decision has been taken into action after considering the country’s current situation and the needs of army officials after their retirement.

According to sources, the FBR may post the relevant notification on its website soon, but all formal requirements were met after seeking permission from the federal cabinet to allow this type of tax exemption.

As per the information gathered from various sources, the exemption of customs duty, sales tax, withholding tax, and Federal Excise Duty (FED) would be applicable on the import of bulletproof vehicles up to 6,000cc. The officers who come under this decision are, the Lieutenant Generals, services chiefs, Chief of Army Staff, and Chairman Joint Chiefs of Staff Committee (CJCSC).

Though, the FBR will permit the said officials to import such vehicles duty and tax-free upon retirement, based on recommendations from the Ministry of Defence. Moreover, all conditions of the Ministry of Commerce’s Import Policy Order must be met in order to import these vehicles, duty and tax-free.

The owners would have to first obtain the FBR’s approval for the sale of bulletproof vehicles after their import. The notification stated that the FBR would recover all duties and taxes that were applicable at the time of import of such vehicles if the vehicle was sold before the five-year period.

According to a senior official who requested anonymity, this is not a new policy, as it was approved by the previous government in 2019.

Read more: