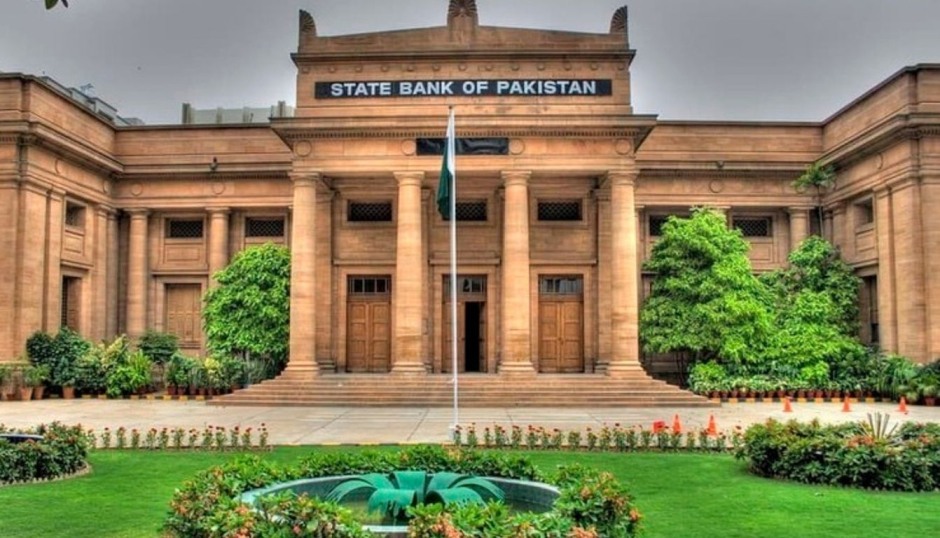

SBP Eases Policy Rate by 2.5% as Inflation Shows Steady Decline

The Monetary Policy Committee (MPC) of the State Bank of Pakistan decided to cut the policy rate by 250 basis points to 15 percent, effective from November 5, 2024. This decision reflects a substantial decline in inflation, which has now approached the MPC’s medium-term target.

A significant decrease in food inflation, favorable global oil prices, and stable gas and Petroleum Development Levy (PDL) rates are among the primary factors that have contributed to this disinflation. The committee continues to exercise caution, acknowledging that inflation may experience some short-term volatility before settling within the target range.

Pakistan’s economic outlook has been fortified by numerous significant developments since the most recent MPC meeting. The sanction of Pakistan’s new Extended Fund Facility (EFF) by the IMF has enhanced investor confidence and increased the likelihood of anticipated external inflows.

Ministry of Industry and Trade indicated that during July-August 2024 the industrial sectors especially textile, food, and automotive industries experienced a significant increase because of the increase in the importation of machinery and raw material. According to the MPC’s estimates, such economic activity should bolster the GDP growth in Pakistan in FY25 at 2.5-3.5%.

The external sector of the country has also depicted the right signs of recovery including the current account surplus extending to September 2024 besides minimizing the cumulative current account deficit to $98 million for Q1-FY25. The reduction in the deficit has been achieved by high worker remittance and an increase in exports while foreign exchange reserves have reached $11.2 billion by October 25th, 2024.

Fiscal performance for Q1-FY25 showed surpluses in both the fiscal and primary balances, largely driven by record profits from the State Bank of Pakistan (SBP). However, now there is an issue in achieving this tax target for FY25 because recently the FBR failed to achieve its tax collection The present situation necessitates fiscal reforms.

Money supply (M2) expansion has exceeded 15% year on year by the end of October, and available credit to the private sector from approved banks, rose after the government intervened to cut its borrowings. Recognizing that expanding financial conditions can increase private sector borrowing desires, the MPC observed that further changes might work to bring about a greater enhancement in credit demand so long as banks recalibrate to ADR triggers.

Year-on-year inflation is now at 6.9% in September and 7.2% in October and the MPC is still hopeful to end FY25 within the inflation band of 5–7%. The committee, nevertheless, flagged some downside risks such as geopolitical risks and food inflation which may affect this projection.

Related Posts

Government Exceeds Auction Target with Rs. 452 Billion Raised Through T-Bills

Islamabad: The Government of Pakistan successfully raised Rs. 452 billion through its latest Treasury Bills (T-Bills) auction, slightly exceeding its target of Rs. 450…

Pakistan’s Exports Surge by 9.98% to $19.55 Billion in First Seven Months of FY 2024-25

ISLAMABAD: The country’s exports increased by 9.98 percent during the first seven months (July-January) of current fiscal year 2024-25 and stood at $19.551 billion…