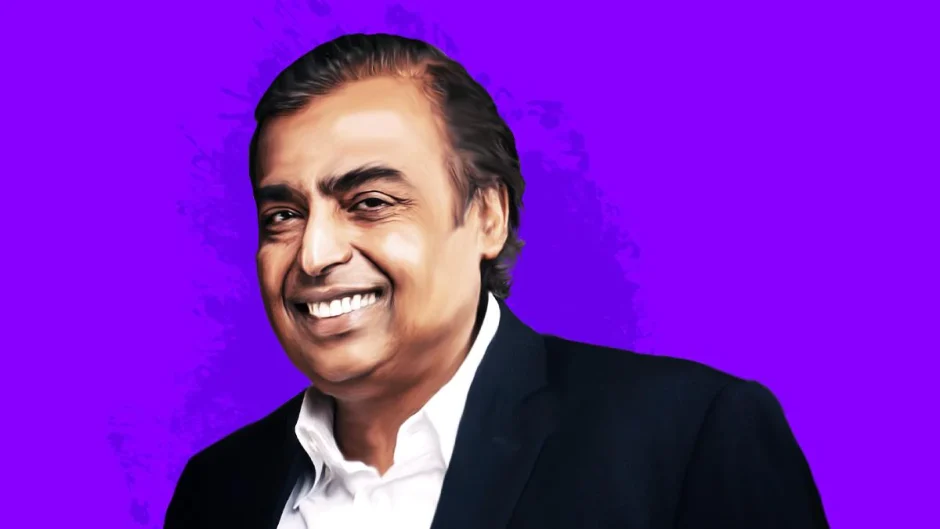

India’s second-richest businessman and the founder of Reliance Industries, Mukesh Ambani, has decided to take his property ownership in Dubai to the next extreme as he has bought the most expensive Villa in Dubai, Palm Jumeirah, which costs about $163 Million. Previously his record for the city’s most expensive residential real estate deal was $80 Million and he has broken that record within a matter of months, according to people familiar with the matter.

Mukesh Ambani bought the Palm Jumeirah mansion last week for about $163 million from the family of Kuwaiti tycoon Mohammed Alshaya. Alshaya’s conglomerate owns the local franchises for retail brands including Starbucks, H&M, and Victoria’s Secret. Ambani is chairman of Reliance Industries Ltd., India’s largest company by market value, and has a net worth of $84 billion.

Mukesh Ambani has been increasing his number of properties overseas for some time and has increased his interest in buying second homes in western countries and seems to always have fewer homes for himself. Reliance spent $79 million last year to buy iconic UK country club Stoke Park and Ambani is also scouting for a property in New York. Ambani’s latest purchase in Dubai is an $80 million home he bought earlier this year which was previously the biggest property deal made, but now a few months ahead, the record has been broken. That deal was the city’s biggest-ever residential sale until another mansion on the palm-shaped island sold for $82.4 million.

The Dubai Land Department reported a property deal worth $163 million in Palm Jumeirah earlier this week, without disclosing the buyer’s identity. A spokesperson for Reliance declined to comment, while representatives for Alshaya didn’t respond to requests for comment. The flurry of record deals underscores Dubai’s recent success at luring some of the world’s wealthiest business executives. The city-state’s property market, which contributes around a third of its economy, is recovering from a seven-year slump thanks to the government’s nimble handling of the Covid-19 pandemic and initiatives aimed at giving expatriates a bigger stake in the economy.

The $80 million mansion purchased by Ambani was actually for his son and was a beach-side villa on Palm Jumeirah, two people familiar with the matter said in August. Among other recent big-name investors in Dubai property is Indian-born billionaire Lakshmi Mittal, the executive chairman of steel giant ArcelorMittal SA, who bought a trio of residential plots in the city, according to people familiar with the matter. Representatives for Mr. Mittal declined to comment on the purchase.

Foreign residents make up more than 80% of the population of the United Arab Emirates. They’ve been a mainstay of the economy for decades, primarily working in the private sector and spending their money on property or shopping in some of the world’s biggest malls. Indians, in particular, have consistently ranked among the top buyers of Dubai real estate. As of the end of last month, the emirate’s prime property prices have surged more than 70% over the past year, the biggest gain on Knight Frank’s global index.

Dubai’s property registry isn’t public and the Land Department doesn’t typically provide access to information on the identities of buyers of specific properties. Some critics say the authorities have little incentive to increase oversight or transparency too much because of the economic benefits of the funds pouring into the housing market. “Dubai is an easy place to buy real estate relatively anonymously,” said Jodi Vittori, a non-resident scholar at the Carnegie Endowment for International Peace, who has researched the emirate’s property sector. “With each international crisis, money seems to flow in there, sometimes encouraged openly like during Covid, but sometimes not as with the Russian conflict. Either way, it will remain a key part of their economic development plan.”

While that’s outpaced gains elsewhere, there have been a few landmark deals globally. In the US, Joe Tsai’s Blue Pool Capital acquired a New York penthouse previously owned by Dan Och for $188 million, while Asia’s most-expensive apartment per square foot sold in Hong Kong for HK$640 million ($82 million) in November. Meanwhile, London’s most expensive home — a Knightsbridge mansion overlooking Hyde Park that changed hands in April 2020 for £210 million ($232 million) — is up for sale again.

Read More: