MicroStrategy Inc., a business intelligence firm turned major Bitcoin investor, announced its purchase of $209 million worth of Bitcoin (BTC-USD) during the week of December 23 to December 29. This marks the eighth consecutive week of cryptocurrency acquisitions for the company, bringing its total holdings to over 446,400 BTC.

The company bought 2,138 Bitcoin tokens at an average cost of around $97,837, as revealed in a form submitted to the United States Securities and Exchange Commission (SEC). Despite Bitcoin’s recent price dip below $100,000 from earlier December highs, MicroStrategy has strategically reduced its weekly Bitcoin acquisitions, reflecting a moderated approach to its investment strategy.

MicroStrategy’s Expanding Bitcoin Strategy

Under the leadership of co-founder and chairman Michael Saylor, the Tysons Corner, Virginia-based company has pursued aggressive Bitcoin acquisitions, leveraging its treasury and market strategies. This approach has propelled MicroStrategy’s market capitalization to over $80 billion, earning it a spot on the Nasdaq 100 Index last week.

The latest acquisition was made through the selling of 592,987 shares as the company is still searching for new methods of funding the Bitcoin plan. MicroStrategy is also asking shareholders for approval to issue more Class A common stock and preferred stock than is currently allowed. If implemented, this decision will offer the company more leeway in its effort to seek capital for more investment in cryptocurrencies.

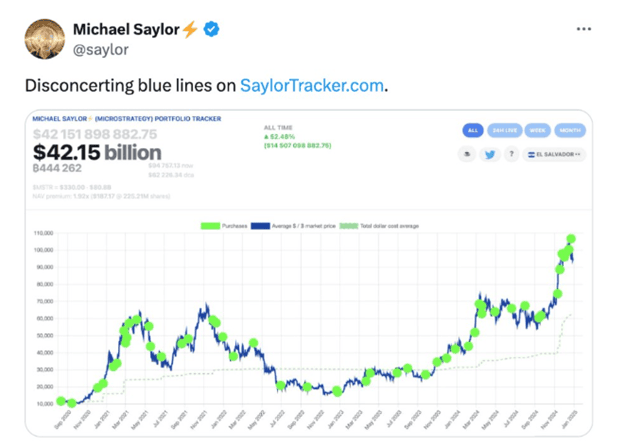

MicroStrategy plans to make $42 billion in stock sales and convertible debt offerings in the next three years to fund more bitcoins. The company has already achieved two-thirds of its capital goals within just two months, setting a rapid pace toward completion ahead of schedule.

Market Dynamics and Volatility

A major contributor to the demand in MicroStrategy securities has been hedge funds, particularly those deploying convertible arbitrage where they bet on the company’s share price fluctuations. MicroStrategy shares have had some volatility, with the stock closing at $302.96 on December 26 and down 8.19% for the day, and further declining in the after-hours.

MicroStrategy’s continued purchases of Bitcoin show its long-term view in the token as well as an investment tool. With the growing list of funding sources, the company remains loyal to Bitcoin which makes it one of the leaders in the cryptocurrency market.

This move not only reinforces MicroStrategy’s influence in the digital asset space but also signals the evolving role of traditional companies in shaping the cryptocurrency landscape.