Karlo Compare promises to clean up your financial mess

We recently sat down to talk with a fairly new startup called Karlo Compare. When you hear the name your first guess would be that its another platform that allows you to compare various products on e-commerce stores. You would be wrong. Karlo Compare is a new startup of its kind in Pakistan that is focusing on solving financial issues.

A venture of Compare On Pakistan Private Limited, it was founded by Sumair Farooqui and Ali Ladhubhai two Pakistani bankers. Their startup is essentially a product comparison platform for personal finance, insurance and other consumer categories. While talking to TechJuice, Sumair Farooqui said:

“We feel that there is a huge information loss regarding products, especially financial services. People don’t really know how to make the right decision. There are many similar services available internationally helping people make the right choice in regards to their finances and insurances. There was none in Pakistan until now. At Karlo Compare we want to provide people with first -hand information. Our main aim is to transform the way personal finance and others services are distributed and accessed. We are striving to build long-term sustainable distribution channels for institutions in Pakistan’s evolving digital ecosystem. ”

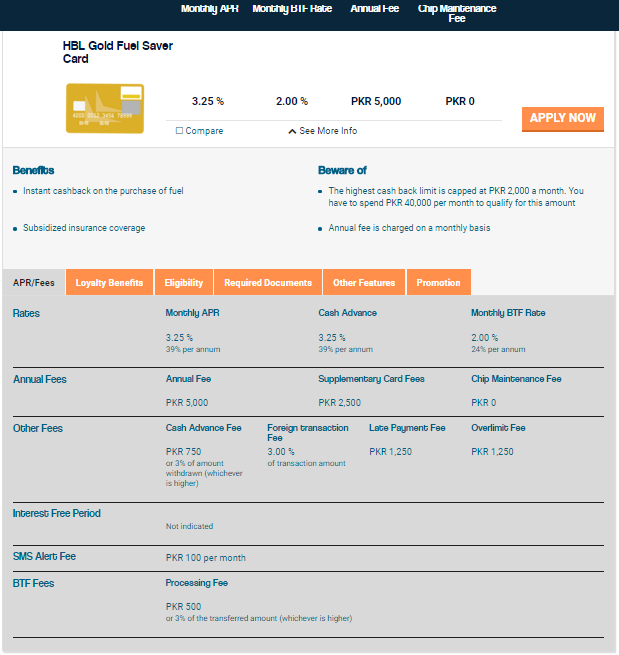

KarloCompare serves as a one-stop place for consumers to browse through a complete range of credit cards, personal and auto loans, travel and auto insurances. Furthermore, it gives service providers the opportunity to build digital acquisition strategies that help them access new segments of the market. It has only been a week since the launch of their website and so naturally there is not much going on at moment. They are only offering deals regarding credit cards and personal loans at the moment. We went forth and tried the credit card deals for ourself. Once we selected the type of deal we wanted, we were presented with numerous credit cards in that category belonging to different banks. Every credit card deal then had a detailed description of its main featues and what sets it apart from others. Once you’ve found a satisfactory product you can then apply for it in which case Karlo Compare puts you in direct contact with the agency/bank in question.

The platform has been started with credit cards and personal loans, with new features, concerning auto loans and insurances, coming soon. The co-founders also hope to add new categories such as broadband services in the very near future.

The co-founders of Karlo Compare are excited about the potential impact their startup could have:

“We hope to give consumers the opportunity to access a product or service that meets their preferences and requirements. KarloCompare.com.pk will help improve product and service literacy amongst Pakistani consumers by ensuring the information on the platform is comprehensive and unbiased. What sets us apart is our approach to list information from all providers in the specific vertical regardless of whether the provider is our acquisition partner or not. Customers will finally be able to make a fully informed decision.”

What sets Karlo Compare apart from others is their very specific focus. There are several websites, Price Match and Shop Buzz in Pakistan, that are offering price comparisons of products on various e-commerce websites. However, Karlo Compare wants to sort out your financial mess. There is a massive infrastructure regarding financial matters and insurance but not enough awareness among people to avail these services in the right manner. Sumair and Ali, with their background as bankers, are doing all the legwork by accumulating necessary information at one place, allowing people to make informed decisions.

I love bringing to light stories of extraordinary people working in Pakistan’s tech and startup industry. You can reach out to me through maryamdodhy@techjuice.pk.

Related Posts

BusCaro Secures Funding from Epic Angels to Expand $6.3M ARR Mobility Business in Pakistan

Pakistani mobility startup, BusCaro, has secured investment from Epic Angels, a global network of female executives and operators, to expand its operations and revolutionize…

Pakistani-Led Disrupt.com Unveils $100 Million Investment to Support Emerging Tech Ventures

UAE-based venture builder Disrupt.com has announced a $100 million investment commitment aimed at supporting early-stage technology startups globally. The initiative targets ventures in artificial…