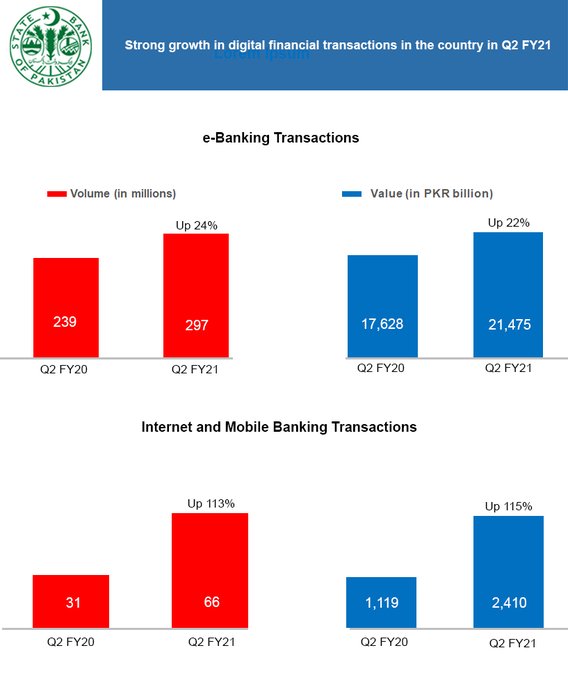

Internet & Mobile banking transactions more than double – up by 113%, with 44.2 million cards issued

The State Bank of Pakistan (SBP) has announced that Internet & mobile banking transactions more than doubled in Q2FY21 over last year – volume up by 113% and value by 115%. The announcement came with the Payment Systems Quarterly report for the second quarter of 2021. The report added that digital means of banking have been gaining popularity in Pakistan as alternatives for faster delivery of banking services to a wide range of customers.

Expanding Infrastructure

Increasing Transactions

As per the report, during the quarter, e-Banking channels including ATM, POS, e-Commerce, and Internet and Call Centers altogether processed 296.7 million transactions valued at Rs.21.4 trillion. ATMs processed the majority chunk with 51% transactions.

Uptick In Registered Mobile phone banking users

The number of registered Mobile Phone Banking users has reached 9.3 million, which is an increase of

5% from last quarter, owing to the provision of an easy and round-the-clock alternative by the internet and banking channels to the customers during the COVID-19 pandemic. The state bank expressed optimism that the increasing trend is expected to continue in the next quarter, due to the steps taken by the State Bank of Pakistan to promote digitization.

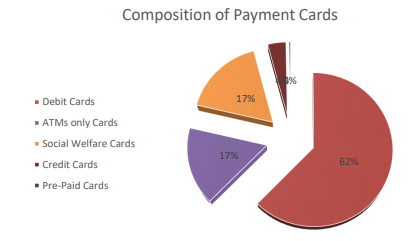

Increase in the number of payment cards issued

The total number of payment cards issued in Pakistan increased to 44.2 million, up from 43 million last quarter, most of whom, almost 62%, are Debit Cards, the state bank reports.

A digital marketing professional specializing in content-based functional areas – Ahsan Zafeer is driven by a never-ending passion for developing, nurturing, and strategizing key content aspects. He writes extensively on tech, digital marketing, SEO, cybersecurity, and emerging technologies. He also serves as a digital marketing strategist and freelance consultant for globally oriented organizations. He tweets @AhsanZafeer

Related Posts

Global Fashion Icon Jimmy Choo Inspires Ambitious Vision for Pakistan’s Fashion Future

ISLAMABAD: As the globally renowned fashion icon Professor Jimmy Choo visits Pakistan. A wide belief reignites that nurturing talent, fostering innovation, and adhering to…

Imran Khan’s Phone Got Stolen—Who’s The Culprit and Why?

LAHORE: Former PTI leader Sher Afzal Marwat has reignited controversy over Imran Khan’s phone, alleging that the stolen devices were handed over to former…