How to open an account at Meezan Bank

Meezan Bank is a Pakistani Islamic bank, was the first of its kind when it was established in 1997 about 22 years ago. Being one the fastest growing financial institution in the banking sector, the bank has more than 650 branches in 180 cities across Pakistan.

Meezan Bank also provides its customers with an array of internet banking services so people can manage their banking affairs from the comfort of their home.

Some of the internet banking services are mentioned below:

- View up to date balances of all your accounts.

- Check details of last 8 transactions. (mini-statements)

- View full details of your transactions. (Download statements into different formats)

- Transfer funds between accounts with the same title

- Fund transfer to accounts of other banks (IBFT).

- Funds transfer to other Meezan Bank accounts.

- Payment of utility bills.

- Online request for issuing Cheque books and pay orders

Let’s look at 3 different types of accounts you can open at Meezan Bank:

- Current account

- Savings account

- Meezan Kids Club

Current Account:

There are 2 types of people who can apply for a current account at Meezan Bank:

- Salaried Individual (Age limit: 18 to 70 years old)

- Business owner (Age limit: 18 to 70 years old)

Salaried Individual:

To apply for a current account at Meezan Bank, you need to collect the following documents:

- CNIC

- Proof of employment (through an employment verification letter)

Business owner:

Collect and submit the following documents to the bank if you want to open a current account at Meezan Bank:

- CNIC

- Proof of business

- NTN certificate of business

After you’ve submitted these documents, you also need to pay a minimum fee of 1000 PKR for account opening while no minimum balance is required for account maintenance (this opening fee is for the Meezan Bank Rupee current account), for more info on different types of Meezan current accounts visit this page.

Features of current account:

- Takaful coverage up to 1 million PKR upon maintaining a minimum monthly balance of 10,000 PKR.

- Unlimited free ATM withdrawals.

- Free online banking facility at all branches.

- Unlimited withdrawals and deposits every month.

Savings Account:

There are 2 types of people who can apply for a savings account at Meezan Bank:

- Salaried Individual (Age limit: 21 to 60 years old)

- Business owner (Age limit: 21 to 65 years old)

Salaried Individual:

To apply for a savings account at Meezan Bank, you need to collect the following documents:

- CNIC

- Proof of employment (through an employment verification letter)

Business owner:

Collect and submit the following documents to the bank if you want to open a savings account at JS Bank:

- CNIC

- Proof of business

- NTN certificate of Business

After submitting these documents you’d also need to pay a minimum fee of 100 PKR for account opening while no minimum balance is required for account maintenance.

The Meezan Bank savings account has an annual equivalence rate (AER)/interest rate of 5%.

Features of savings account:

- Free Takaful coverage up to 1 million PKR in case of death.

- Profit calculated on daily average balance.

- Profit rate depends upon the deposited amount.

- Withdrawals and credit balance limit amount 500,000 PKR.

Meezan Kids Club account:

Meezan bank has also introduced banking services for its young customers (under the age of 12) where children can save their monthly allowance while simultaneously learning the importance of saving.

You can open your Meezan Kids Club account with as little as 500 PKR.

Features of Meezan Kids Club account:

- Free personalized cheque books.

- Gifts on account opening.

- Kids Club certificate.

- Personalized Debit Card.

- Halal profits on a monthly basis.

So if you wish to open your own account at Meezan Bank, head on to your nearest Meezan branch to apply or download the account opening form.

Not convinced? Here is a complete list of all Pakistani banks where you can open your accounts:

- How to open an account in Bank AL-Habib

- How to open an account in Bank Alfalah

- How to Open an Account in Askari Bank Limited

- How to open an account in Habib Bank Limited (HBL)

- How to open an account in Bank Al Baraka

- How to open an account at BankIslami

- How to open an account at MCB Bank

- How to open an account at Faysal Bank

- How to open an account at Bank of Khyber

- How to open an account at Allied Bank

- How to open an account at National Bank of Pakistan (NBP)

Content Team Lead. Blogger, Content Developer, Social Media, and SEO Expert. Reach out: shaheryar.ehsan@techjuice.pk

Related Posts

How to Recover Instagram Account – Disabled, Hacked, or Deleted

Losing access to your Instagram account can be frustrating, especially if it’s disabled, hacked, or deleted. Whether your account was restricted for violating policies…

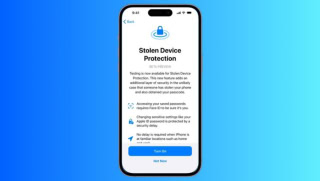

How to Enable Stolen Device Protection on Your iPhone

In today’s digital age, smartphones are not just communication tools; they are personal vaults holding sensitive information. Apple’s iPhone, known for its robust security…