Federal Board of Revenue has announced flat rates against various price segments on the import of mobile phones to set aside any ambiguities. Previously, we saw that a feature phone was mistakenly charged Rs. 45,000 customs duty because of an incorrect IMEI number. The flat rates will help in educating the mass public regarding the tax they would have to pay on their imported phones when they come back to Pakistan.

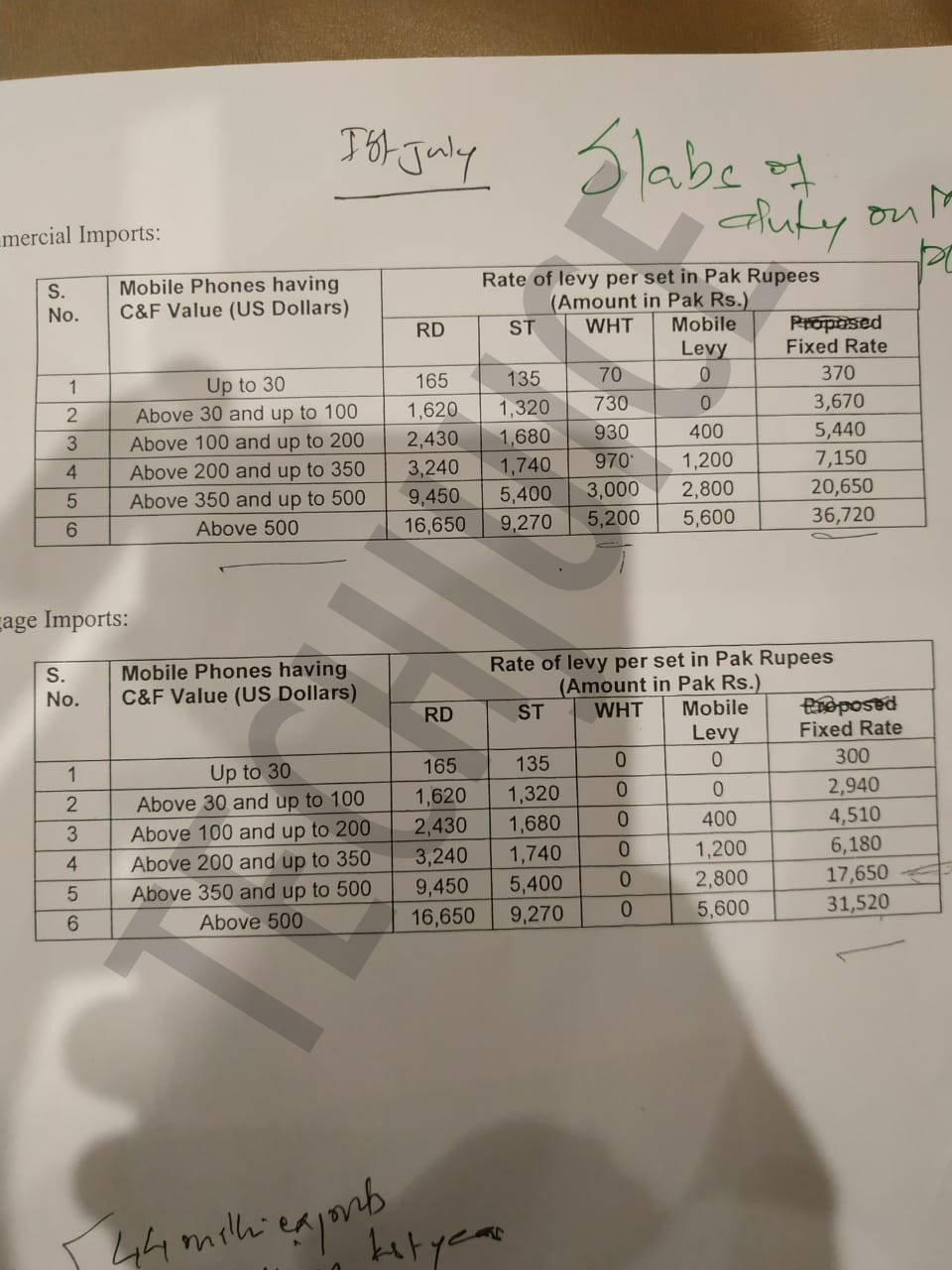

The imported mobile pricing has been divided into two main categories of Commercial Imports and Baggage (Individual) Imports. These two have been further divided into 6 main pricing segments starting from below 30 USD. If we discuss the Commercial Imports first, phones priced below $30 will be charged a flat rate of Rs. 370. Phones which are priced between $30 and less than $100 will be charged Rs. 3,670. Similarly, between the range of $100 and $200, phones will be charged a flat rate Rs. 5,440.

Moving towards the mid-range section of phones, those handsets priced between $200 and $350 will be charged a flat rate of Rs. 7,150. Handsets between $350 and $500 will be charged a flat fee of Rs. 20,650. Finally, we have the beyond $500 category which mostly consists of flagships and high-end smartphones which will be charged a flat fee of Rs. 36,720.

Moving on towards taxation on individuals bringing their personal phones through the baggage rule, passengers will have to pay a tax of Rs. 300 for phones costing less than $30. Phones priced between $30 and $100 will be charged Rs. 2,940 as tax whereas those between the range of USD 200 and USD 350 will be charged Rs. 6,180 duty.

Moving on towards the higher segment, handsets between $350 and $500 will be charged Rs. 17,640 whereas those above $500, we are talking about high-end devices, will be charged a flat rate of Rs. 31,520 as tax.