Federal Board of Revenue proposed a list of duty deduction on the imports of different products. Mobile phones are top of the list, and it has been proposed that upto 51% duty cut will be imposed on their import.

This proposal was handed in by FBR after they realized that the increase in the regulatory duties on phones slowed down the mobile phones imports. This proved to be harmful to our economy. Pakistan has a budding market for electronics, and smartphones are at its peak. FBR made it clear that the move would not affect the duty collection and will only increase the volume of imports.

Regulatory duty reduction on the import of mobile phones was also done in the previous budget by Pakistan Tehreek-e-Insaf. The current expected change is big and will help the government gain the importers’ trust.

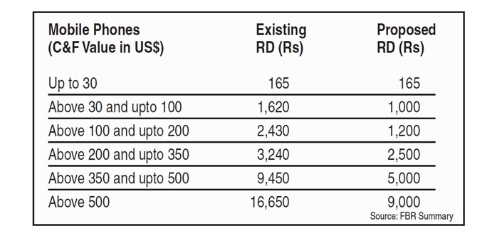

The proposal has a list of duty deductions on the bases of different categories, and mobile phones cost between $30 to $500 will get up to 51% less duty. People paying Rs 2430 on a mobile phone that costs around $100 to $200 will now be paying only Rs 1200 per unit.

There are a few people who are not happy about this initiative. The local manufacturers ![]() have shown their rage on the proposed summary of Federal Board of Revenue to the Finance Ministry.

have shown their rage on the proposed summary of Federal Board of Revenue to the Finance Ministry.

After the start of trade war between China and USA, US manufacturers are leaving China and have started trade with other countries. It is a great opportunity for Pakistan to attract those companies to build their plants in the country. Government is finalizing the local mobile manufacturing policy without wasting any more time. The, Commerce Adviser to PM, Razak Dawood and the Engineering Development Board are in talks regarding this matter.