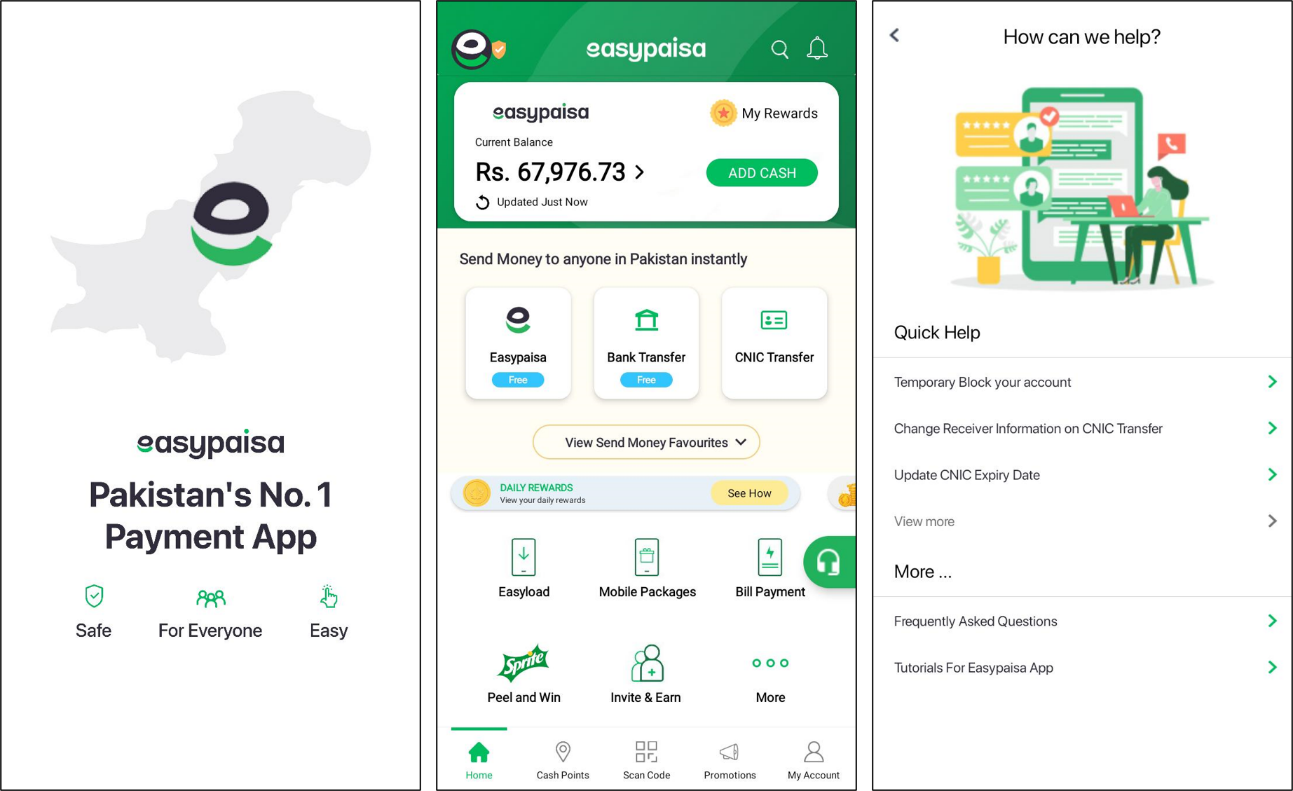

Easypaisa, Pakistan’s No. 1 Payment App, has launched a self-service customer support option for its users from within the Easypaisa App. This new feature now enables users to resolve a variety of problems and get responses to their queries instantly without the need of calling the Easypaisa helpline. Customers using the Easypaisa App will now be able to use this support menu to instantly block their own Easypaisa Accounts for security purposes, update their account credentials as well as their Nadra verification details as well as make changes to their Money Transfers sent to CNICs by correcting the CNIC details or by reversing the Money Transfers to a CNIC completely.

Easypaisa has always focused on providing the best user experience across available channels for its customers and the platform continues to innovate through more accessible complaint resolution channels in this digital era. The platform seeks to eliminate hindrances in customer servicing by offering a wide range of channels through which customers can seek information and have their queries resolved. In addition to existing customer support channels, this in-app support is an innovative way of enhancing the Easypaisa user experience whereby users have the ability to solve their issues on their own without depending on a customer service agent.

Commenting on this development, Omar Moeen Malik, the Business Head for Easypaisa said;

“Customer experience is one of the most essential elements of any service offering. With our customer-focused approach, we at Easypaisa are always looking for newer and effective ways to create value for our customers. By digitizing the popular complaints at our helplines and providing them in the Easypaisa App directly for customers to access, we believe we offer a greater level of financial freedom and convenience for all of our valued customers”.

With almost 10 million customers using the Easypaisa App in the last 30-days across the Android and iOS platforms, Easypaisa is the most used Pakistani App across all categories and remains committed to transforming Pakistan into a cashless and financially inclusive society through the power of collaboration & technology.