Cambridge University just published its first research on cryptocurrency. Even though more than 300 academic research articles have been published on cryptocurrency till this date, but it is the first time that a leading university has done research on such scale.

This study gathered data from 114 cryptocurrency organizations and individual miners. 38 countries from around the world were covered in this research and have revealed some interesting information. Dr. Garrick Hileman and Michael Rauchs, the authors of this report said, “We estimate that our benchmarking study captured more than 75% of the four cryptocurrency industry sectors covered in this report.”

Ths study was conducted by Cambridge University Judge Business School’s Centre for Alternative Finance. According to its authors, “It is the first study of its kind to holistically examine the burgeoning global cryptocurrency industry and its key constituents, which include exchanges, wallets, payments, and mining.”

Here are some interesting highlights of the report:

Exchanges

- In a data collected from 51 exchanges in 27 countries globally, mostly from Europe and Asia-Pacific, it revealed that 52 % of small exchanges hold a formal government license compared to 35% of large exchanges.

- Overall global cryptocurrency trading volume is dominated by a few exchanges (USD, EUR, JPY, and CNY).

- To store cryptocurrency, 92% of exchanges use cold-storage systems on average 87% of funds are kept in cold storage

Wallets

- A number of active wallet users are between 5.8 million and 11.5 million.

- Mobile wallet apps are the most widely offered format, followed by desktop and web.

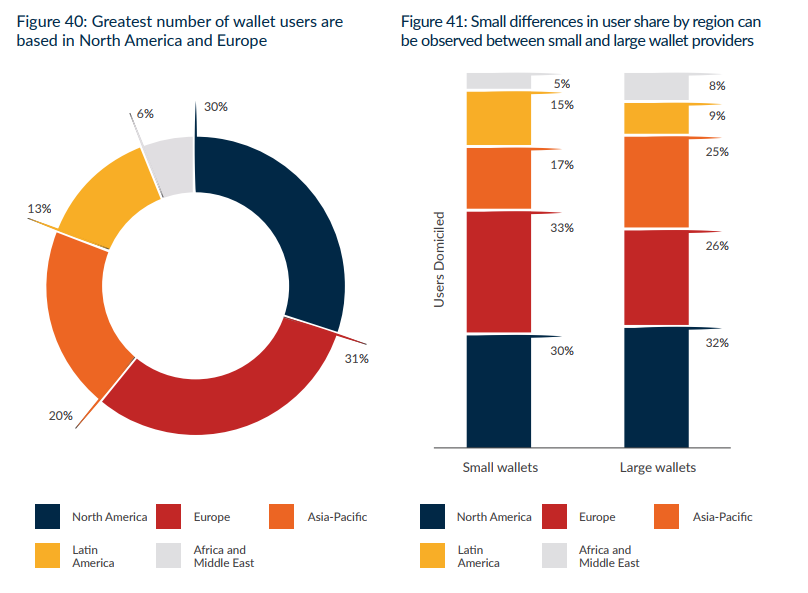

- 81% of wallet providers are based in North America and Europe, however, only 61% of their customers are based in these two regions.

- 24% of incorporated wallets hold a formal government license; all of them are wallets that offer national-to cryptocurrency exchange services.

- 73% of wallets do not control private keys (meaning they do not have access to user funds); 12% of wallets let the user decide whether to have sole control over private keys.

Mining

- Bitcoin mining consumes about 10.41 TWh per year, which is almost equal to the yearly energy consumption of Uruguay, a country with 3.3 million inhabitants.

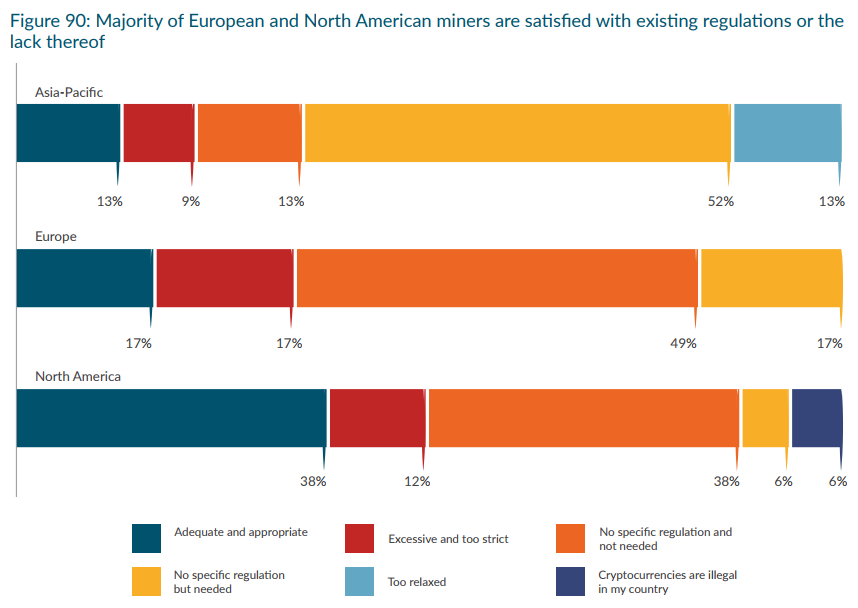

- The two risk factors that both small and large miners consider high are the possibility that governments will increase taxes on mining profits, as well as the potential introduction of tighter regulations that create barriers to either mining and/ or cryptocurrency adoption in general.

- Both small and large miners prefer cryptocurrencies to be treated as a commodity over currency for tax purposes.