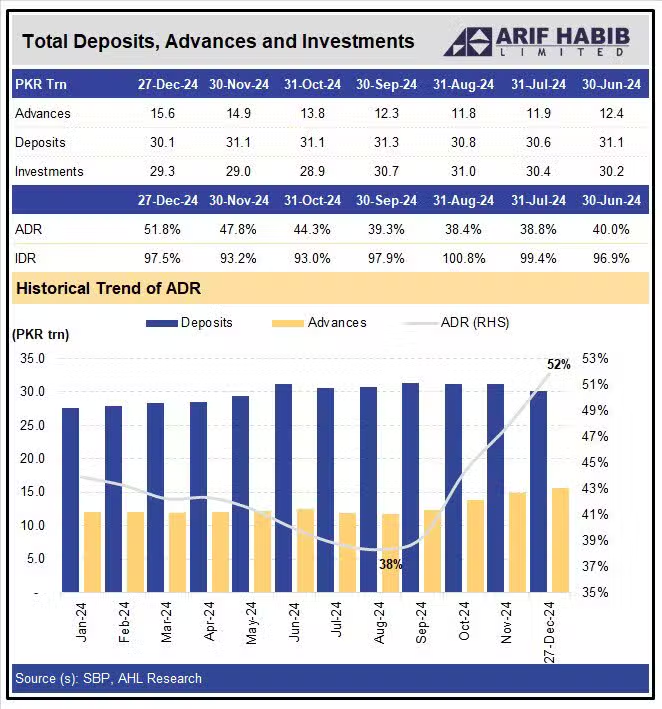

The State Bank of Pakistan (SBP) has reported a remarkable increase of Rs. 700 billion in bank advances as of December 27th, 2024. The banking sector’s Advance-to-Deposit Ratio (ADR) marked a significant recovery, climbing to 51.8% after hitting a low of 38.4% in August 2024.

This rebound showcases a significant rise of 13.5 percentage points, underscoring the sector’s strengthening position, as highlighted in an analysis by Arif Habib Limited. Between August 2024 and December 27th, 2024, there has been a 2.3% decline in deposits, contrasted by a significant 32.0% rise in advances.

The sector’s total advances climbed to Rs. 15.6 trillion by the close of December, up from Rs. 14.9 trillion at the end of November 2024, reflecting a month-on-month (MoM) increase of 4.7%.

In December, as of the 27th, bank investments experienced a modest rise of Rs. 0.3 trillion, reflecting a 1 percent month-on-month increase, bringing the total to Rs. 29.3 trillion, as reported by the SBP.

The investment-to-deposit ratio reached 97.3% as of December 27, 2024. As of December 27, bank deposits totaled Rs. 30.1 trillion, reflecting a decrease of 3.2% from Rs. 31.1 trillion the previous month.