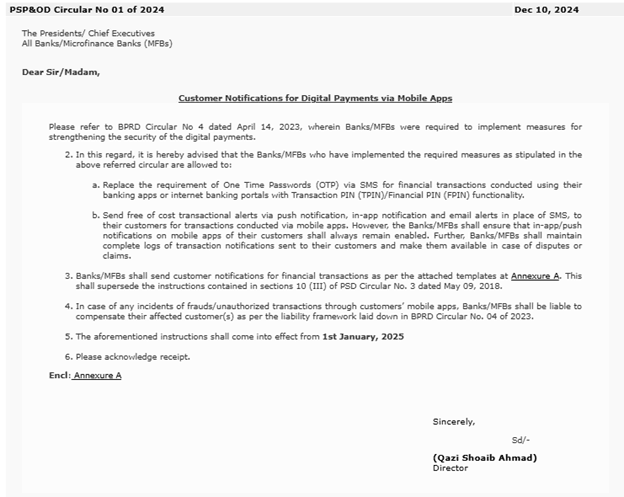

The State Bank of Pakistan (SBP) has issued a new series of directives for banks and microfinance banks (MFBs) that have adopted the necessary measures to enhance the security of digital payment systems.

The banks will be required to replace the One Time Password (OTP) via SMS for financial transactions made through their banking apps or internet banking portals with Transaction PIN (TPIN) functionality, according to the circular issued to the Presidents/Chief Executives of all Banks/MFBs.

Banks will be required to provide complimentary transactional notices to their customers through push notifications, in-app notifications, and email alerts, rather than utilizing SMS, for transactions executed via mobile applications.

However, the Banks and Microfinance Banks (MFBs) must guarantee that in-app and push notifications on their clients’ mobile applications are consistently enabled.

Furthermore, banks and microfinance banks (MFBs) are required to maintain comprehensive records of transaction notifications dispatched to their consumers and to ensure their availability in the event of disputes or claims. Banks/MFBs are required to dispatch customer notifications regarding financial transactions under the specified templates.

In case of any incidents involving fraud or unauthorized transactions conducted via customers’ mobile applications, banks and microfinance banks (MFBs) shall bear the responsibility to compensate the affected customers. The instructions will take effect on January 1st, 2025.