Prime Minister Imran Khan has launched the new “Kamyab Jawan Programme” to provide easy loan to the enthusiast young population to help them start their own business.

Pakistan Tehreek e Insaf government has finally decided to do something for youth population which played a great role in the success of PTI in the election 2018. Pakistan has a large number of young entrepreneurs, who can expand their businesses with the help of these loans.

In the first stage, the government has allocated 100 billion rupees for the programme. It will provide technical and financial assistance to people between the ages of 21 to 45. Having an ID card is must, therefore young people who want to start a business related to the IT or e-commerce has to be at least 18 years old.

Addressing the ceremony, Imran Khan said “Rs10bn will be used for teaching skills to 100,000 young people. Under the programme, the prime minister announced, 100 labs will be established for distance learning.”

“The programme will also arrange internships through which 25,000 young people will be connected with industries,” He added, “2,000 teachers will be sent abroad for international-level training.”

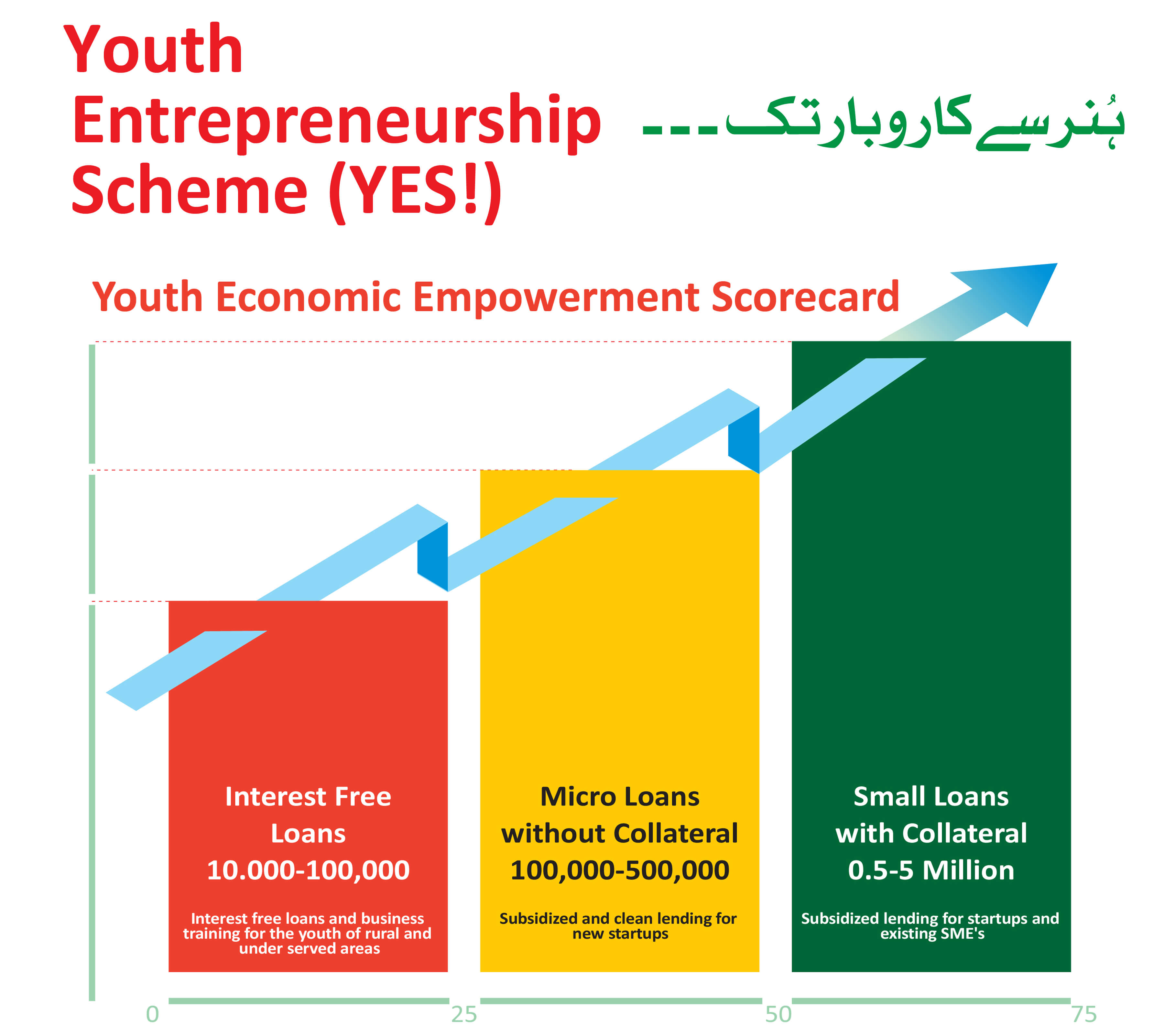

The loan programme is divided into three tiers, in the first tier up to 1 lac of loan would be interest free, in the second tier, people can take loan of 100,000 to 500,000 Rs, which they would have to return with interest rate of 6% per annum, third and last tier offers 5-50 lacs Rs loan with the interest rate of 8% per annum. The loan can be taken for 8 years period. To encourage women, the programme has special quota of Rs25bn.

The programme will benefit almost one million young population. It will be distributed in 45 underprivileged districts on a priority basis. Three major banks including National Bank of Pakistan, Bank of Punjab and Bank of Khyber will be distributing loan in the whole country.

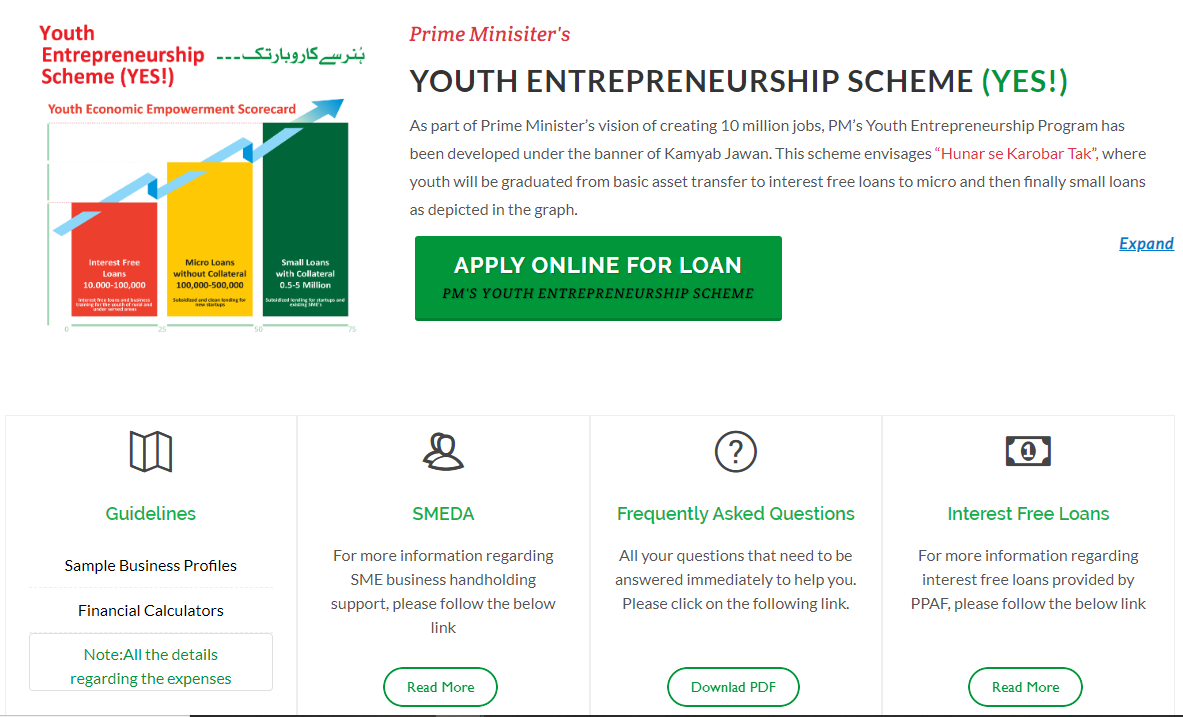

Here are the easy steps to Apply Online:

- Loan applications can only get submitted online, the form is available on the website.

- On the website, there are two option given, one is “Visit Portal” to get more information about the programme and the other one is “Apply For Loan“

- By clicking on the second option, you will land on this page

- You will be given different options for guidance for online application.

- Other than this, you can also visit any branch of one of the above-mentioned banks for guidance and assistance.

- No documents are required at the time of online form submission.

- by clicking on the button of “Apply online for Loan”, you will be taken to the form.

- Enter mandatory information in all sections. Enter exact information, otherwise, your application will not be submitted.

- After submitting the application, the branch of your selected bank located near you will be automatically selected and an SMS will be delivered to your provided mobile phone number with confirmation and bank details.