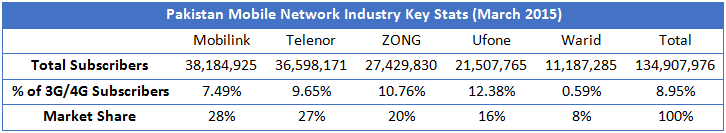

Pakistan has one of the largest mobile network user base in the region with more than 134 million users of mobile phones (10% YOY Average Growth). Pakistan Cellular Tele-density (% of cellular users in a population) stands at 72% with industry divided between five players.

Average revenue generated by a user in a month fell to 200 PKR

Competition remains high with network providers introducing fancy packages to attract new customers. Barriers of entry are high because of significant capital expenditure involved in the form of infrastructural investments and licensing fees. The threat of customers remains high due to low switching costs. Mobile network providers have remained dependent on low value added products (voice + SMS) due to delay in license issuance of 3G/4G. As a result, the Average Revenue generated by a User in a Month (ARPU), a key metric of cellular industry profitability, fell to PKR 200 in FY2014 compared to PKR 217 in FY2013. It is interesting to note here is that the ARPU fell despite a 40% jump in voice traffic between mobile networks in FY2014.

However, recently Pakistan Mobile Network industry underwent significant structural changes recently with the auction of 3G/4G licenses. Mobile network providers invested nearly USD 1.8 Billion dollars on infrastructure upgrade and licensing fees in 2014. Since then, 3G/4G subscriber base has grown steadily with currently 10% of the subscribers actively using 3G/4G services.

Bio-metric verification, a major reason of dismal financial performance

Owing to the launch of much awaited 3G/4G services in Pakistan, it was expected that the upcoming months will be heaven in terms of user growth and financials. But with the recent terrorist activities in the country, PTA demanded biometric sim re-verification to curb increasing terrorism. The major consequences of the decision were a drop in user base and additional cost of bio-metric verification equipment. As a result, mobile network operators have produced very dismal financial performance in 1QFY2015.

Telenor & Zong beating the competitors

A competitive analysis of mobile operators, over last two years, yields some interesting results. Mobilink, Ufone, and Warid have lost market share to Telenor and ZONG. ZONG has emerged to be the fastest growing mobile operator in Pakistan in last two years. Furthermore, Telenor has the largest 3G subscribers in Pakistan among all operators mainly due to user location of Telenor in cities.

Going forward, due to improved penetration of 3G/4G supported handsets (currently at 17%) and growing subscriber base, we expect an improvement.

Now let’s talk about Mobilink.

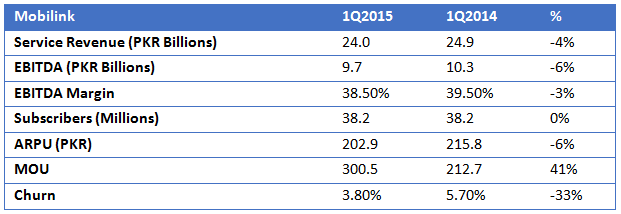

Mobilink announces financial report of 1st quarter 2015

Mobilink, the largest Cellular Services provider in Pakistan, recently announced financial results of first quarter. Revenue declined by 4% to PKR 24 Billion compared to PKR 24.9 in the corresponding period a year ago. Major reasons behind the fall in revenue are attributed to the current SIM verification campaign by PTA and lower Value Added Services revenue.

3G penetration of Mobilink

3G penetration in Mobilink network has been on third position falling behind Telenor and Zong. Furthermore, EBITDA Margin (an indicator of profitability), fell by 100 basis points (bps) to 38.5% due to bio-metric verification system cost and aggressive competition. The company states that excluding verification system cost, EBITDA margin in fact improved to 41.5% in 1Q2015. The steep decline in ARPU is a major concern.

Going forward, we expect an improvement in ARPU as the company is projecting steep growth in mobile data revenue with a low churn rate (% of users leaving a network). Nevertheless, stiff competition from Telenor and ZONG in network coverage and voice/data packages, will continue to put downward pressure on the financial performance.

Some facts from Mobile Network Industry

- In 2014, Average revenue generated from a user per month fell to 200 PKR.

- Mobilink, Ufone, and Warid have lost market share to Telenor and ZONG.

- ZONG has emerged to be the fastest growing mobile operator in Pakistan in last two years.

- Telenor has the largest 3G subscribers in Pakistan.

- According to Mobilink, major reasons behind the fall in revenue in first quarter of 2015 are attributed to the current SIM verification campaign by PTA.

Source: PTA Annual Report 2014, GTelecom, PTA